In the last few months, predicting the gloom and doom of Indian startups has become almost, well, fashionable. There’s a boatload of analysis in the media, and dozens of questions raised on the internet every single day: Are Indian startups alive simply because of venture capital? Are Indian startups overvalued? Is the Indian market simply not big/rich/savvy enough?

All these questions are flawed. The reality is something different. Let’s take a look at some of the statements being tossed about liberally these days and break them down one by one.

The India-China comparisons

Argument 1: The Chinese market is closed, and the Indian market is open.

Here’s a common perception: since the Indian internet is mostly English, and since our politicians don’t control digital media companies like the Chinese do, the Facebook of India is Facebook, the Google of India is Google, the Amazon of India is Amazon, and the Uber of India is Uber — not homegrown competitors.

However, it isn’t fair to generalise this. Google and Facebook are technology companies, while Amazon and Uber are operations powered by technology. An Indian equivalent of Amazon or Uber has a shot at success as much as these American giants. Moreover, when Google and Facebook entered the Indian market, our startup ecosystem was non-existent. So a Flipkart or an Ola are significantly ahead in India, why would VCs not back them?

Different countries have different challenges. Amazon did not fail in China because of a closed economy – it failed because a homegrown competitor, Alibaba, beat them. Similarly, Uber faced an uphill battle in China because of Didi Kuaidi. I think VCs are right to bet on local startups against global players.

Argument 2: The size of the Indian market is smaller than it was thought to be initially.

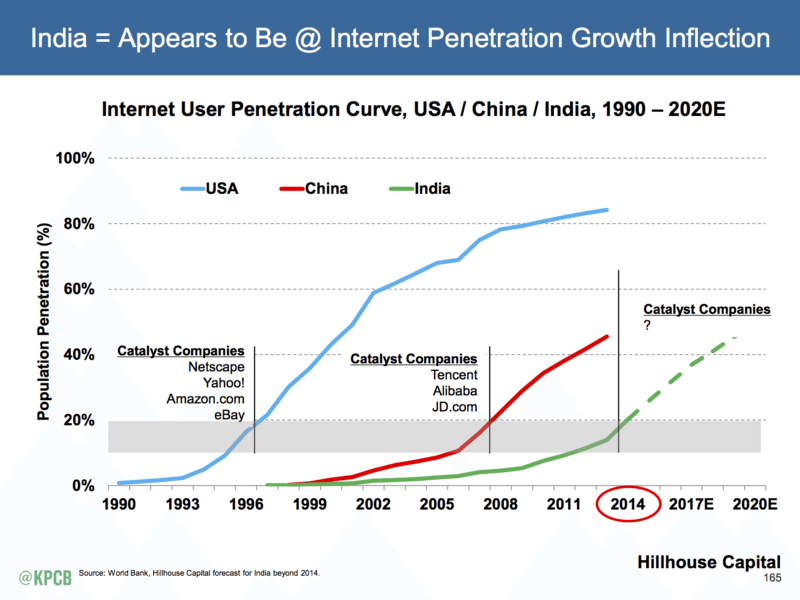

Internet adoption always follows a pattern. People first go online for fun, light stuff like instant messaging. As they get more comfortable, they start using the internet for more ‘serious’ things like research, education, and shopping. My parents, who live in a small Indian town, are now comfortable with buying things online – something that was unthinkable even a year ago. We are at an inflection point for online shopping in India.

Which is why I am amazed that very few VCs are accounting for this potential explosive growth when estimating the size of the market. VCs exist to provide risk capital. Otherwise, they are no better than bank loans.

Indian startups are copycats

How many times have you heard someone lamenting about Indian startups simply copying their Silicon Valley counterparts? Well, guess what’s happening all around the world? The same thing.

China’s Alibaba and Japan’s Rakuten copied Amazon, Didi Kuaidi, China’s leading on-demand taxi service, ripped off Uber. If it worked for them, why will it not work for India?

Does this mean I am supporting copycat models? Yes. Am I against “real innovation” or new ideas? Let me give you an example. My first startup, ShoppersOn, was aimed at disrupting the loyalty points market. It was too early to market – I launched it in 2011 – and it died. A small experiment I ran called Parallelway is what is being done today by Roadrunnr and Swiggy. So I am a firm believer in new ideas.

But I support the copycats because it’s not just the idea that makes a startup, it’s the execution – and Flipkart, OlaCabs, Swiggy and Roadrunnr are executing really well.

Valuation is everything

Now that Morgan Stanley has market down Flipkart by 27%, everyone’s pointing fingers at VC-funded startups in India and using it as an opportunity to pull them down. I think this is because of our lack of understanding of financial markets.

In a down market, every company goes through a valuation correction. In fact, I would be more worried if this correction wasn’t happening once in a while. The Indian real estate market, for instance, has not corrected for years now and has been down in the dumps (real estate prices still need a 30% correction).

It is true that market perception is one of the factors that determines the valuation of a company, and a negative perception does affect a company financially. But does it make a difference in the real value of the company? I don’t think so.

I understand that startups that depend on external funding have to do a tricky balancing act, because a down round is often seen as a negative signal. I think the best strategy for startups would be to wait through this phase. The memories of a market are short, perception eventually gets back to normal, and raising money after that is easier.

And sometimes, down rounds happen simply due to global slowdowns. That shouldn’t be a ding against a particular startup in my opinion.

Losing money means certain death

Yet another thing happens when a company’s valuation starts being questioned: everyone starts asking questions about its burn rate. This is such a short-sighted way of looking at things!

I’m attributing this to the fact that India has never seen a tech startup scale first and make money later. If an Indian entrepreneur attempts – audaciously – to be the next Google or Facebook and burns a ton of cash doing so, how do you think they will be perceived in the current environment?

The current perception that Indian startups are only able to sustain themselves thanks to VCs pouring in money couldn’t be further from the truth.

Technology businesses are very different from manufacturing or services businesses, and they come with their own nuances. Understanding these is no mean task. Heck, even the best entrepreneurs learn these after a really, really long time (if at all).

The current perception that Indian startups are only able to sustain themselves thanks to VCs pouring in money couldn’t be further from the truth. Entrepreneurs think about making money and breaking even every single day.

Entrepreneurs – the good ones, at any rate – choose long-term benefits over short-term gains (think Jeff Bezos and Amazon). You can’t do both. It’s like having each leg in a different boat and trying to cross a channel.

Bootstrapped or VC-funded? There’s only one right way to be successful

The perception that venture capital is bad stems from fact: you lose control of your startup once VC money controls it. While this is true, it can be managed. Mark Zuckerberg raised a lot of money for Facebook, and yet controls a significant portion of decision-making. Managing this tightrope walk needs education, knowledge-sharing, and, above all, vision.

The other side is also true. Some of my friends bootstrapped their startups and are rocking their companies. In fact, bootstrapped startups often have to be inventive and innovate to beat VC-funded startups that solve problems by throwing money at them.

Does this mean that VC-funded startups don’t innovate? They do, but their approach is just more visible.

So, you see, there’s no one true approach. That’s the beauty of this.

People starting up are too young

This one’s ironic. Youth, which was once a celebrated trait in entrepreneurship, is now cited as a raison d’être for the doom and gloom in the Indian startup ecosystem. A certain section of people don’t like the I-care-a-damn approach of young entrepreneurs.

It’s true that most young people fresh out of college are a little rough and unpolished in their approach – but that’s a good thing!

At Koove, a social shopping startup I run, we value this unpolished approach because it often brings with it an aggressive, never-give-up attitude. Most young people who are infatuated with the startup world don’t want to start a company to become CEO – they want to learn the ropes fast and get better. They mean business and they mean it now. In a startup, they learn what the real world is like. There’s a hunger that only comes when you’re young – and it’s this hunger that the startup ecosystem needs to thrive.

Layoffs are always bad news

Remember when IBM, Infosys and TCS laid off thousands of people and no one batted an eye? No one said: “Why did they hire so many people in the first place if he had to fire them?”

And yet, each time a startup fires employees, fingers are immediately pointed to the founders (“Their strategy was wrong from the first day!”, “They are going to shut down!”, “What were they thinking?”)

Startups move fast and grow fast. They hire fast and fire fast. It’s OK if people don’t understand the logic behind it.

Listen: no one hires to fire later. Startups hire people to solve problems at work. The easiest way to solve something is to put more brains behind it. However, things change, approach changes, and course correction happens – not just with startups but big corporates as well.

The difference is that startups move fast and grow fast. They hire fast and fire fast. It’s OK if people don’t understand the logic behind it.

Hiring doesn’t reflect the success of a company, and firing doesn’t reflect its failure. Sometimes, a startup might hire more people because it’s struggling to solve a specific problem – which means it probably needs help.

And oh, raising money rarely reflects the success and failure of a startup. Housing.com, for instance, was considered a success as it raised one round after another. As the money dried up, it was called a failure. Meanwhile India’s housing sector is still a mess.

There’s a severe talent-crunch

Some people think that entrepreneurship is a skill that you only find in India’s top-tier colleges. I disagree. The quality of talent in small colleges in India’s thousands of small towns has gone up considerably. Four years back, finding great talent even at the IITs or the NIT was a challenge.

Meanwhile, colleges themselves have changed. Most of them directly encourage entrepreneurial skills, and students are working hard to excel in fields beyond plain academics. They are longer content with getting placed in cushy jobs in MNCs once they graduate.

Being unsettled is the new “settled”.

My advice to entrepreneurs around the country? Ignore the naysayers. Be real, be grounded – but don’t be shaken. It’s not worth it.

Subscribe to FactorDaily

Our daily brief keeps thousands of readers ahead of the curve. More signals, less noise.